The renminbi has surpassed the yen’s share of worldwide value transactions for the first time in nearly two years, as low charges of curiosity in China improve the enchantment of its overseas cash for financing commerce with the world’s second-largest monetary system.

Figures launched on Wednesday by worldwide funds platform Swift confirmed the renminbi’s share of worldwide funds had climbed to 4.6 per cent in November, up from 3.6 per cent a month sooner than. It surpassed the yen for the first time since January 2022 to develop to be the fourth most-used world overseas cash behind the pound sterling, euro and US buck.

The renminbi has been among the many many worst-performing world currencies this yr, falling about 3.5 per cent to Rmb7.15 in opposition to the buck throughout the face of sluggish Chinese language language growth and points over a liquidity catastrophe throughout the nation’s property sector.

Analysts talked about the renminbi’s latest world funds good factors had been susceptible to be welcomed by Beijing, which is keen to increase the overseas cash’s worldwide profile as part of a broader drive to mitigate the hazard posed to China by the US buck’s longtime dominance of worldwide finance.

Chi Lo, senior Asia-Pacific strategist at BNP Paribas Asset Administration, talked about there had been a delicate string of constructive developments favouring the renminbi’s worldwide use this yr and that November’s readings “might even be the start of a slowly rising growth for the renminbi’s share of Swift [payments] “.

Economists talked about the most recent rise was largely attributable to lower Chinese language language charges of curiosity which, whereas driving worldwide investor outflows from the nation’s onshore bond market, have moreover made the overseas cash further aggressive throughout the realm of commerce finance. China’s benchmark one-year mortgage prime cost presently stands at 3.45 per cent, whereas the bottom for the US federal funds cost is 5.25 per cent.

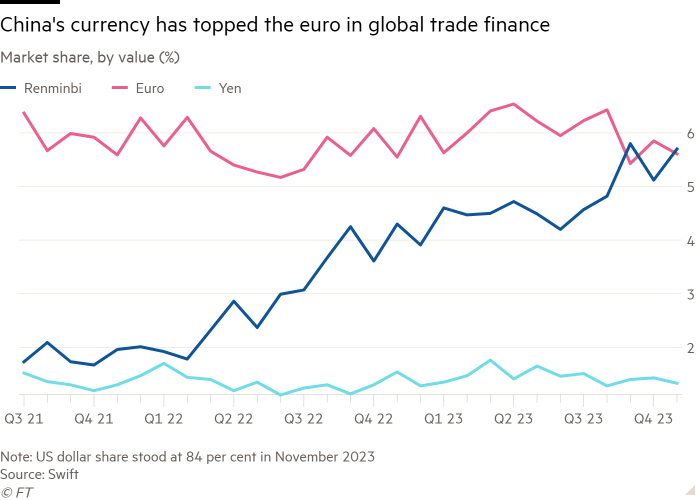

The attraction of lower Chinese language language fees is mirrored in Swift figures monitoring the renminbi’s share of commerce finance, which rose to 5.7 per cent in November, up from 5.1 per cent the sooner month. That pushed the overseas cash to second place merely above the euro, which had dropped beneath the renminbi for the first time in September.

Every currencies nonetheless badly lag behind the buck, which accounts for higher than 80 per cent of the worldwide commerce financing market.

“The underlying dynamics for commerce finance have been altering in newest months as renminbi charges of curiosity have edged lower,” talked about Kelvin Lau, senior economist for greater China at Customary Chartered.

With China’s central monetary establishment leaning within the route of looser monetary protection whereas western central banks saved fees elevated, Lau talked about the value of financing commerce with renminbi had dropped far ample to develop to be participating for some shopping for and promoting companions.

“This new phenomenon of the renminbi being seen as a low fee of curiosity overseas cash opens up the door for China’s overseas cash to play an excellent greater place in commerce finance,” he added.

The case for greater use of the renminbi in world funds — notably via channels that bypass Swift — has moreover been bolstered by western sanctions on nations along with Russia, which have put completely different economies on edge over the chance of wider weaponisation of the buck.

“The acceleration of funds in renminbi is partly a reflection of the geopolitical state of affairs we’re seeing,” Mansoor Mohi-uddin, chief economist at Monetary establishment of Singapore, talked about. “That and long-term developments in commerce flows may be accelerating the uptake of China’s overseas cash.”

Carlos Casanova, senior economist for Asia at UBP, talked about: “Russia isn’t 100 per cent of the story. We moreover see an increase in settlements inside Asia and with completely different economies which have extreme dependency on Chinese language language demand.”