In a groundbreaking financial shift, Bitcoin, the world’s distinctive and deeply capitalized cryptocurrency, has swiftly climbed the ranks, securing its place among the many many prime 15 largest currencies globally. Daring, a Bitcoin financial institution card agency, revealed this excellent feat in December, emphasizing Bitcoin’s uniqueness as the one actual crypto throughout the prime 20 currencies of sovereign central banks.

Inspecting the data provided by CEIC and CoinGecko paints a vivid picture of Bitcoin’s extraordinary ascent. On the pivotal date of November 19, Bitcoin’s market capitalization soared to over $835 billion, solidifying its place among the many many world financial giants.

Bitcoin’s Meteoric Rise: Overtaking Worldwide Currencies

This milestone not solely marked an enormous leap forward for Bitcoin however moreover propelled it earlier India’s rupee, which stood at a bit over $693 billion in November.

The narrative of Bitcoin’s triumph doesn’t stop there. Surpassing nationwide currencies with ease, Bitcoin continued its meteoric rise, outshining even the venerable Swiss Franc.

By reaching a staggering market capitalization of $830 billion, Bitcoin showcased not solely its financial prowess however moreover its resilience in a panorama often outlined by volatility.

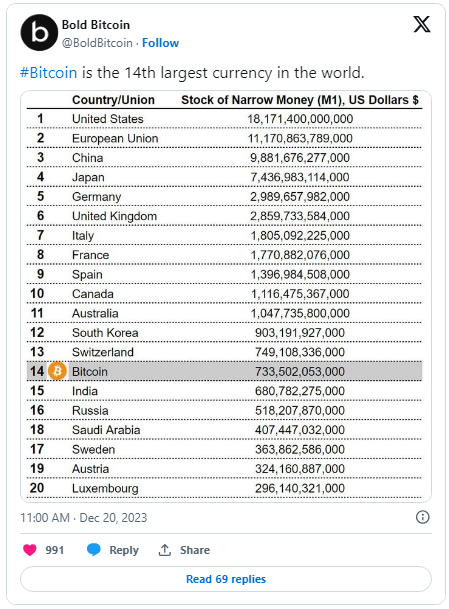

Daring’s guidelines areas Bitcoin merely behind South Korea’s Obtained, boasting a market cap of $903 billion. FiatMarketCap, nonetheless, positions Bitcoin as a result of the sixteenth largest international cash by market cap when considering all currencies throughout the guidelines.

#Bitcoin is the 14th largest international cash on the earth. pic.twitter.com/PvKqvYAtjx

— Daring Bitcoin (@BoldBitcoin) December 20, 2023

The month of December witnessed a palpable surge in Bitcoin’s value, propelled by the heightened anticipation surrounding spot ETFs. This burgeoning pleasure not solely elevated Bitcoin’s market standing however moreover facilitated a noteworthy milestone.

All through this period of heightened anticipation, Bitcoin, with unwavering momentum, not solely surpassed the valuation of the Swiss Franc nonetheless went a step further, closing in on the esteemed South Korean Obtained.

The strategic alignment of market forces, coupled with rising investor confidence, carried out a pivotal operate on this achievement, showcasing Bitcoin’s resilience and adaptableness in responding to evolving market conditions.

Bitcoin slides once more into the $42K territory. Chart: TradingView.com

On the current shopping for and promoting value of $42,427, Bitcoin expert a slight dip of 0.7% and 1.1% throughout the ultimate 24 hours and seven days, respectively, in step with Coingecko’s info.

Bitcoin: Troublesome Worldwide Overseas cash Norms

An fascinating perspective emerges when considering Bitcoin’s potential. If its value have been to reach over $919, it should exceed the US dollar’s money present of $18 trillion, establishing itself as an important world international cash.

The discuss over whether or not or not cryptocurrencies are true currencies stays vigorous. The American Affiliation for the Growth of Science, in a evaluation article printed on December 22, implies that whereas digital currencies are an enormous enchancment, they’ve however to serve broadly as a medium of alternate.

Contrastingly, a Geopolitical Monitor article on November 10 sees potential in Bitcoin turning into a major reserve international cash, influencing the worldwide monetary order.

‘Explosive’ Future For The King Coin

Wanting ahead, 2024 appears to be a “very explosive” year for Bitcoin, with expectations of ETFs, legislative developments, and regulatory shifts. Brandon Zemp, CEO of BlockHash LLC, anticipates growth throughout the crypto enterprise, emphasizing its cyclical nature and the resilience demonstrated no matter challenges in earlier years.

Encouragingly, the crypto enterprise is firmly established, with a gentle purge of malicious actors enhancing consciousness for improved practices and safeguards. Anticipating a forthcoming bull market, there’s optimism that this half could exhibit greater stability and longevity, primarily attributed to the systematic elimination of undesirable elements from the enterprise, as highlighted by Zemp.

“The good news is that crypto is true right here to stay and harmful actors are frequently being flushed out of the market,” he talked about.

Featured image from Shutterstock

Disclaimer: The article is obtainable for educational capabilities solely. It doesn’t symbolize the opinions of NewsBTC on whether or not or to not buy, promote or keep any investments and naturally investing carries risks. You’re advised to conduct your private evaluation sooner than making any funding decisions. Use data provided on this website fully at your private hazard.